Standard Chartered Bank LATAM : Driving Growth & Inclusion

When the world talks about diversity and inclusion, it often drifts into abstractions. Germana Cruz—CEO for Brazil and Latin America at Standard Chartered —takes the opposite approach. Over more than two decades in the bank, she has opened a bank in Brazil, unwound it a decade later, and led teams across Brazil, Argentina and Colombia. Her method is straightforward: design a framework, localize it, resource it, measure it, iterate. No gloss. No posters. Just delivery.

“We adapt more to the new generation than the other way around,” she says. “Technology is a given. But human relationships take time.” That sentence sums up her operating philosophy: embrace speed where it helps, protect the slow work that compounds over time.

A Global Framework That Actually Travels

Here’s a twist on the common storyline. While many multinationals export D&I from the U.S. or Europe, Standard Chartered’s core playbook was forged in Asia, where the bank’s historic centre of gravity sits between Singapore and Hong Kong. For Cruz, that matters in Latin America. “The core, the basic, we use the framework that was originally defined in Asia,” she says. Because market realities rhyme—emerging economies, uneven infrastructure, fast adoption curves—Cruz finds the guidance “translates quite seamlessly.” Her teams still make local adjustments, but much of the heavy lift “is already contemplated.”

That Asian lineage showed its value in 2020. Having lived through SARS, Standard Chartered had laptops, contingency plans and PPE in place years before COVID hit. “Talking to our colleagues in Asia,” Cruz recalls, “they told me: this is not a short-term thing… airports will close.” That readiness ensured continuity of service for clients – and stability for staff.

Building A Talent Pipeline

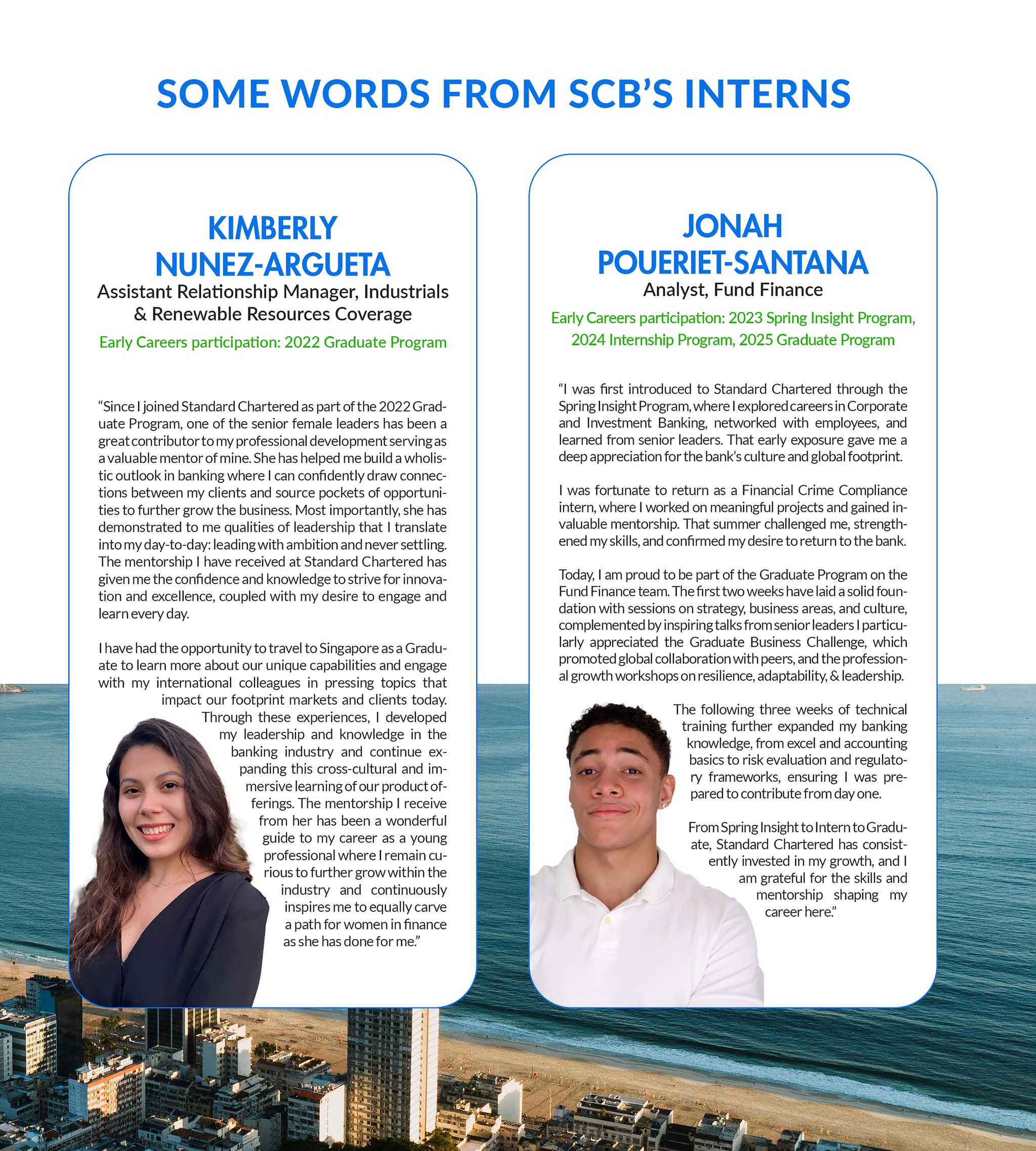

Cruz is allergic to vanity metrics and more on talent flow. Recruitment is broad, but the real engine is internal mobility. The Bank offers two early careers opportunities - Internship and Graduate Program, combining structured training with mentorship from senior managers. The guiding rule: always search internally first for open roles, and make sure hiring managers see a wide pool of candidates.

“As part of our D&I council for the Americas,” she explains, “we make sure recruiting gives managers access to a broader set of applicants.” If the skills aren’t inside the Bank, they’ll look externally. Most of the time, they find them within.

The pandemic stress-tested that system. As talent scattered across borders, some never returned to offices. “Even externally we were not finding candidates,” Cruz says. The answer wasn’t panic hiring - it was doubling down on development and retention, so the next shock doesn’t drain capability.

Cruz also invites accountability. She welcomes putting graduates of the pipeline on the record precisely because it validates the structure. “It provides the visibility they deserve,” she says. Translation: if you claim mobility works, show the people who moved.

Reaching The Real Economy

Brazil’s challenges are layered—geography, class and access to capital. Cruz’s answer is to support growth where it is most needed ; youth, micro-enterprise, and the under-capitalised regions that rarely get corporate attention.

Through Futuremakers, Standard Chartered’s global initiative focused on youth, entrepreneurship and financial education, the bank partners with Enactus to back student-run ventures across Brazil. The projects range from water access to food security, with a deliberate focus beyond São Paulo and Rio into Amazon and interior states.

The second track goes straight at small entrepreneurs in Brazil’s poorer north and northeast. This programme isn’t age-bound and, this year, the emphasis is on women-led businesses. The support stack is practical: coaching, training, and financing. The objective is blunt. Keep small businesses alive long enough to formalize, hire and climb out of poverty.

“Sometimes you have a whole family in cocoa,” Cruz says. “They can produce a kind of chocolate, but it’s not something that could be sold.” The fix is often unglamorous —basic productization, bookkeeping, separating personal and business accounts—but it’s the difference between a household income and a closed door. “It’s simple to us,” she adds, “transformative for them.” If that sounds hands-on, it is. Cruz mentors founders herself, often in group sessions that demystify how a bank underwrites risk: what documents matter, how to present, what a loan officer needs to say yes. It’s a small thing that compounds. When entrepreneurs understand the rules of capital, they stop guessing—and start planning.

Metrics Without Spin

Cruz insists this work is about delivery, not image. Volunteer engagement is tracked through hard data, Employees get extra paid days for volunteering; those days are logged by project and audited through the HR system. The roll-up appears in Standard Chartered’s annual reporting. Inside the bank, engagement surveys allow HR to correlate volunteering with employee sentiment and retention. It isn’t perfect causality—few people-metrics are—but it’s measurable, transparent and consistent.

“Our concept is not to do propaganda,” Cruz says. “We want to integrate these efforts be into day-to-day business and make sure everybody understands what we’re trying to reach.” That attitude—practice first, publish later—tracks with how her career unfolded. She never chased the title. She invested in skills, took stretched roles, and made herself useful. Senior leaders noticed. Opportunity met readiness.

Hybrid Work: Flexibility As A Talent Magnet, Discipline As A Guardrail

Standard Chartered offered flexibility before hybrid became a buzzword. COVID just formalised it. The policy Cruz runs is intentionally human: young, single employees who crave community can come in daily; parents and carers can flex around life. New hires—whether interns or experienced—are expected to be on-site for the first two to three months to absorb culture, build relationships and learn how the place actually works. After that: hybrid.

“I’m still not clear that performance is impacted by being in the office,” she says. “High performance isn’t measured by presence.” What matters is management: setting expectations, removing blocks, reading the person in front of you. Some people will try to hide in hybrid; good leaders don’t let them.

In Brazil, she’s seen clear results: “Hybrid has been working. People are happy. Flexibility helps us attract talents.”

Leadership Without Theatre

What cuts through in conversation with Cruz is the absence of performance. She talks about inclusion the way operators talk about margins: concrete, measurable, iterative. She also talks about people—employees and entrepreneurs—with the calm conviction of someone who’s spent years watching potential turn into output.

“I enjoy mentorship,” she says. “It’s rewarding to see my experience adding value to somebody. And I learn from them too.” That reciprocity matters. It’s how you keep a 26-year-old analyst and a 60-year-old client equally engaged.

It also explains why her approach avoids the trap of helping only the already-visible. By steering money and mentorship toward the youth who will set-up tomorrow’s companies, and the micro-enterprises that keep today’s communities afloat, Cruz is betting on Brazil’s real economy—not just its boardrooms.

The Compound Effect

Cruz would never frame her strategy as grand theory. But in practice, it is. She runs D&I the way she’s run her own career: pragmatic, disciplined, open to evolution, but never mistaking noise for signal. She knows some things can be sped up—technology, recruitment channels, product cycles. And she knows some things can’t—trust, mentorship, culture.

“Some things can be faster,” she says. “Other things cannot.”

That’s not a hedge. It’s a strategy. And in a region that has weathered volatility for centuries, it’s the kind that endures.

Germana Cruz, CEO & Head of Financial Institutions, SCB LATAM